A great article on theMintTheCoin campaign; which is a proposal to side-step the US government’s self-imposed (and weaponised) debt ceiling by having the government instruct the Mint to create a $1 trillion platinum coin. Well worth a read.

https://www.vox.com/platform/amp/22711346/trillion-dollar-coin-mintthecoin-debt-ceiling-beowulf

Included in the article is some discussion about how Republicans know full well that they are not constrained in their ability to spend, and in fact use crises and sometimes manufacture crises to achieve the political cover needed for the spending, or tax cuts, they desire to undertake. Going back to Reagan, Republicans have used their knowledge of how little fiscal constraint they actually have so as to achieve their political goals, sometimes by nefarious means.

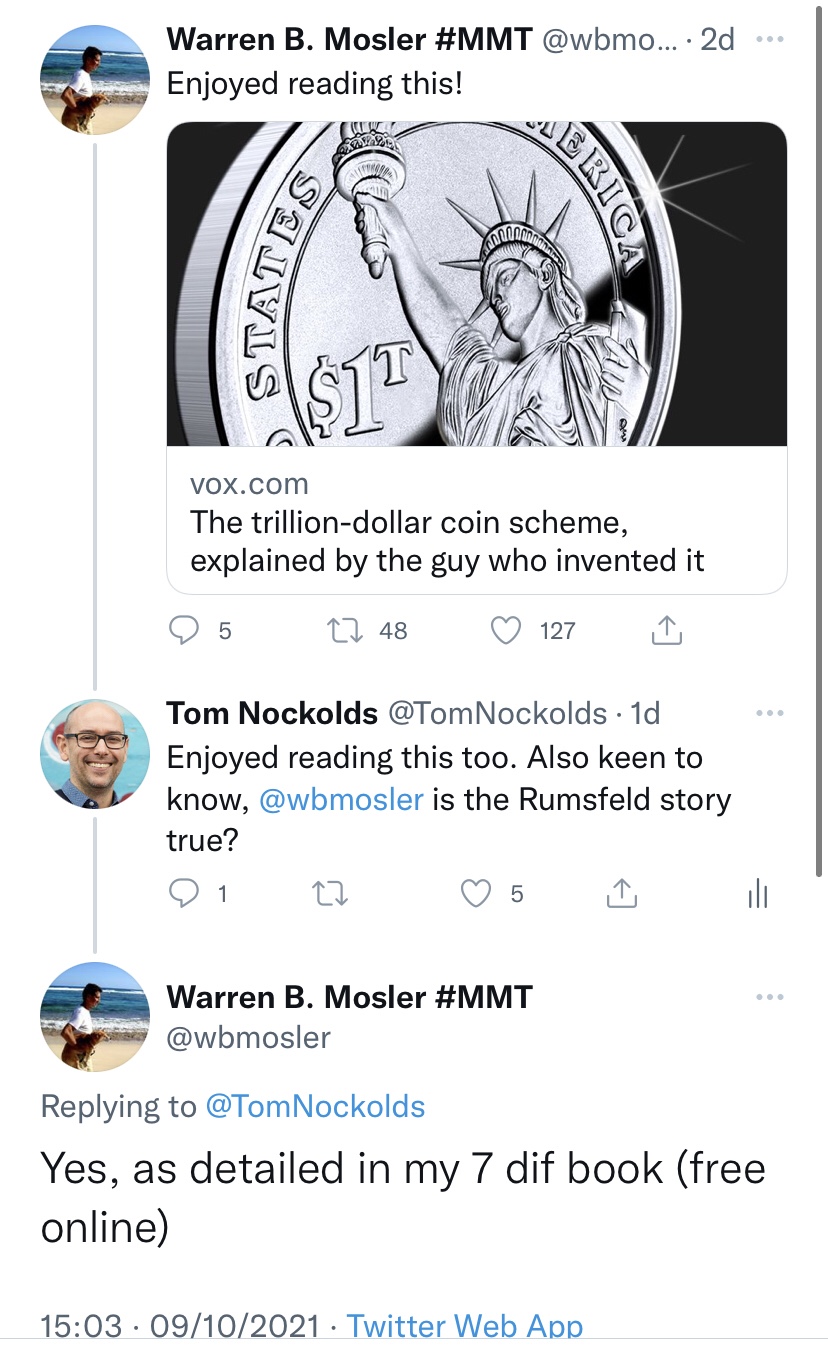

It was then suggested that Reagan learnt this from Donald Rumsfeld, who in turn learnt this from…Warren Mosler! I took the opportunity to ask if it was true.

Warren Mosler is legendary for generosity with his time, and demonstrated this by replying to my low level tweet. To my embarrassment, I later realised the reference to Donald Rumsfeld learning MMT from Warren Mosler had a URL link in the article.

Warren Mosler is legendary for generosity with his time, and demonstrated this by replying to my low level tweet. To my embarrassment, I later realised the reference to Donald Rumsfeld learning MMT from Warren Mosler had a URL link in the article.

It has been a long time coming for me to read the Deadly Innocent Frauds book. It is free to download as a PDF and I got started on it today.

http://moslereconomics.com/wp-content/powerpoints/7DIF.pdf

First impressions of this 2010 publication are positive with a longer review/testimonial from L Randall Wray and then a foreword by James Galbraith. James’ father was John Galbraith, Professor of Economics at Harvard and intellectual opponent to Milton Friedman. James Galbraith’s foreword sets an expectation of an easily approachable book with this paragraph.

The common thread tying these themes together is simplicity itself. It’s that modern money is a spreadsheet! It works by computer! When government spends or lends, it does so by adding numbers to private bank accounts. When it taxes, it marks those same accounts down. When it borrows, it shifts funds from a demand deposit (called a reserve account) to savings (called a securities account). And that for practical purposes is all there is. The money government spends doesn’t come from anywhere, and it doesn’t cost anything to produce. The government therefore cannot run out.

The first words from Warren (the Prologue) describe Professor John Galbraith, how he (John) was the source of the the phrase “innocent fraud” and how he believed, as Keynes did, in the power of public spending, AKA fiscal policy. Sadly the history on this has been written and Milton Friedman and his Monetarists won the day, along with their belief that monetary policy, the actions of the central bank, was a better tool for controlling inflation in the economy.

Mosler also sets the historical scene describing the 70’s oil crisis as the deciding factor in the Monetarists victory. The oil crisis caused inflation coupled with stagnating economic growth – so called “stagflation” – but the reason for this from Mosler’s perspective was simply cost-push inflation caused by the oil cartel (i.e. monopoly) raising prices which in turn caused inflation. Because oil is such an important input into the economy, the inflationary and stagnating effects were felt economy wide. The ultimate resolution was increased supply, which is just what you would expect with a cost-push inflation event. As easy to understand as this might be, this is not the mainstream economics (neo-classical) view of inflation in the 70s and the oil crisis.

The reason Mosler wrote this book is stated as…

This book’s purpose is to promote the restoration of American prosperity.

…and…

How are you going to pay for it???!!!

This is the killer question, the one no one gets right, and getting the answer to this question right is the core of the public purpose behind writing this book.

But I’ve now stepped in to the first of the seven deadly innocent frauds. Something I’ll take notes on another time.

DIFDeadly-Innocent-FraudsMint-the-CoinModern-Monetary-TheoryMMTEconomics